Fiscal Policy: Steering the Economic Ship

Analytixon-com, a leading economic analysis platform, understands that fiscal policy stands as a cornerstone of modern economic management. It represents the strategic use of government spending and taxation to influence a nation’s economic performance. Unlike monetary policy, which is primarily managed by central banks, fiscal policy is the domain of the government, reflecting its priorities and societal objectives. Effective fiscal policy can foster economic growth, stabilize the economy during downturns, and address long-term challenges such as income inequality and environmental sustainability.

Understanding the Levers of Fiscal Policy

At its core, fiscal policy operates through two primary levers: government spending and taxation.

- Government Spending: This encompasses all expenditures made by the government on goods, services, and transfer payments. Infrastructure projects, education, healthcare, defense, and social security benefits all fall under this category. Increased government spending directly injects demand into the economy, stimulating production and employment.

- Taxation: Taxation is the means by which the government collects revenue from individuals and businesses. Tax policies can be designed to encourage or discourage specific behaviors. For example, tax incentives for renewable energy can promote environmental sustainability, while higher taxes on luxury goods can address income inequality.

Types of Fiscal Policy

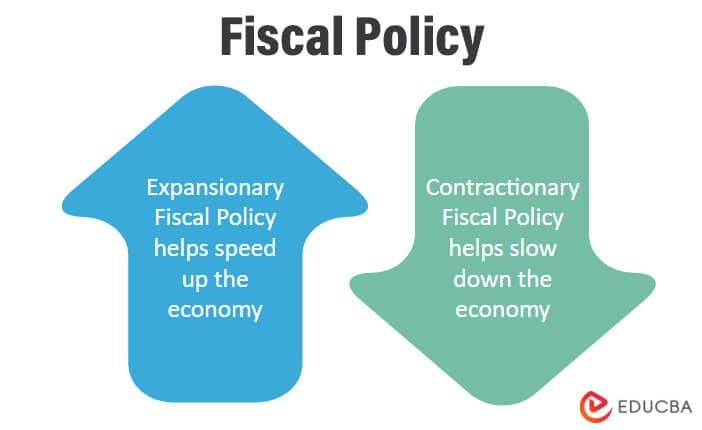

Fiscal policy can be broadly categorized into two main types:

- Expansionary Fiscal Policy: This is employed during economic slowdowns or recessions to boost aggregate demand. It typically involves increasing government spending and/or reducing taxes. The goal is to put more money into the hands of consumers and businesses, encouraging them to spend and invest, thereby stimulating economic activity.

- Contractionary Fiscal Policy: This is implemented when the economy is overheating, experiencing high inflation, or facing unsustainable levels of debt. It entails decreasing government spending and/or increasing taxes. The aim is to cool down the economy, reduce inflationary pressures, and reduce the national debt.

The Multiplier Effect

A key concept in understanding the impact of fiscal policy is the multiplier effect. When the government spends money or cuts taxes, the initial impact is amplified as the money circulates through the economy. For example, if the government spends $1 billion on infrastructure projects, the construction companies hired will use that money to pay their workers, who will then spend it on goods and services. This additional spending creates further demand, leading to increased production and employment. The size of the multiplier effect depends on factors such as the marginal propensity to consume (how much people spend versus save) and the level of imports.

Automatic Stabilizers

In addition to discretionary fiscal policy measures, many economies have automatic stabilizers built into their fiscal systems. These are programs that automatically adjust government spending and taxation in response to economic fluctuations. For example, during a recession, unemployment benefits automatically increase as more people lose their jobs, providing a safety net and supporting aggregate demand. Similarly, progressive tax systems, where higher earners pay a larger percentage of their income in taxes, automatically collect more revenue during economic booms and less during downturns, helping to stabilize the economy.

The Role of Fiscal Policy in Different Economic Scenarios

The appropriate fiscal policy response depends on the specific economic conditions facing a country.

- Recession: During a recession, expansionary fiscal policy is typically recommended to boost aggregate demand and stimulate economic growth. This can involve infrastructure spending, tax cuts for low- and middle-income earners, and increased unemployment benefits.

- Inflation: When inflation is high, contractionary fiscal policy may be necessary to cool down the economy. This can involve reducing government spending, raising taxes, and tightening monetary policy.

- Debt Crisis: Countries facing high levels of debt may need to implement austerity measures, which involve cutting government spending and raising taxes to reduce the debt burden. However, austerity can also have negative effects on economic growth, so it must be carefully managed.

- Long-Term Growth: Fiscal policy can also be used to promote long-term economic growth by investing in education, research and development, and infrastructure. These investments can increase productivity and competitiveness, leading to higher living standards in the long run.

Challenges and Limitations of Fiscal Policy

While fiscal policy can be a powerful tool for economic management, it also faces several challenges and limitations:

- Time Lags: It can take time for fiscal policy measures to be implemented and to have an impact on the economy. This is due to factors such as legislative delays, bureaucratic processes, and the time it takes for consumers and businesses to respond to changes in government spending and taxation.

- Political Constraints: Fiscal policy decisions are often subject to political considerations, which can make it difficult to implement the optimal policy response. For example, politicians may be reluctant to raise taxes or cut spending, even if it is necessary to stabilize the economy.

- Crowding Out: Expansionary fiscal policy can sometimes lead to crowding out, where increased government borrowing drives up interest rates, reducing private investment. This can offset some of the positive effects of fiscal stimulus.

- Debt Sustainability: If fiscal policy is not managed prudently, it can lead to unsustainable levels of debt. High levels of debt can make it more difficult for a country to borrow money in the future, and can also lead to higher interest rates and lower economic growth.

- Uncertainty: The effects of fiscal policy can be uncertain, as they depend on a variety of factors, such as the state of the economy, the behavior of consumers and businesses, and the response of other countries.

The Interplay with Monetary Policy

Fiscal policy does not operate in isolation. It is often coordinated with monetary policy, which is managed by central banks. Monetary policy involves controlling the money supply and interest rates to influence economic activity. In general, fiscal and monetary policy are used in tandem to achieve macroeconomic stability. For example, during a recession, the government may implement expansionary fiscal policy while the central bank lowers interest rates to further stimulate the economy.

Fiscal Policy in the 21st Century

In the 21st century, fiscal policy faces new challenges, such as globalization, technological change, and demographic shifts. These challenges require policymakers to adopt a more flexible and adaptive approach to fiscal policy. For example, as the global economy becomes more integrated, countries need to coordinate their fiscal policies to avoid unintended consequences. Similarly, as technology continues to disrupt industries, governments need to invest in education and training to prepare workers for the jobs of the future.

Conclusion

Fiscal policy is a vital tool for managing the economy and promoting economic well-being. By carefully adjusting government spending and taxation, policymakers can influence aggregate demand, stabilize the economy, and address long-term challenges. However, fiscal policy also faces several challenges and limitations, including time lags, political constraints, and the risk of crowding out. Effective fiscal policy requires careful planning, coordination with monetary policy, and a deep understanding of the economy.

:max_bytes(150000):strip_icc()/DDM_INV_fiscal-policy_df-5199e67bb34b4dcf83b058fa61ca4ad9.jpg)